Credit Widget Redesign

Redesigning the AutoVerify credit widget — our credit tool placed on dealership websites

My role

Lead product designer

UX Research

Product vision and thinking

Workshop facilitation

Designed the new widget

My team

Software Developers

Product Manager

Integrations Manager

Marketing Manager

Timeline

3 months

Background

Redesigning the credit widget was something that the team wanted to do ever since I joined the company in July 2020.

The credit widget is placed on dealership websites, search pages (SRPs) and individual vehicle pages (VDPs) that allows car shoppers to get TransUnion authenticated information about their credit score - this also generates a lead.

At first glance, visually, it no longer fit with our brand guidelines and it has an outdated design that looked like an ad.

Refresh the existing credit widget for existing customers with

updated branding guidelines

Reimagine the language to build trust with car shoppers and better manage expectations

Give dealers the opportunity to customize the widget so that it fits seamlessly on their website

The Opportunity

To assess the overall user experience of the credit widget, uncover user pain points when using the credit tool and increase user workflow completion.

Research Goals

Process & Planning

Research Insights

First phase: Generative research

I ran some user tests to assess the current experience of the credit widget on dealership websites, and uncovered these insights:

Looks like an ad/out of place

“would rather do his credit check somewhere else bc of the way this button looks”

“Looks like a random google ad thrown in”

Would not click unless they are 200% sure about the vehicle

Users are unlikely to click it

Users have different expectations

Users expect that they would need to put in their SIN/SSN

Users expect to see what kind of financing and interest rates

Users expect that it would direct them to their bank

Ideation Workshop with PMs and Developers

I shared the user testing feedback and dealer feedback from our Customer Success team.

With my team of developers and product manager, we aligned on the user and dealer problems with our current credit widget to an ideate on opportunities.

Workshop Takeaways

Language to reflect readiness to buy - a credit check doesn’t mean they have to make a decision on a particular vehicle

Manage expectations with clearer messaging

Remove bank logos

TransUnion branding - builds trust

Different language depending on which page (eg. SRP vs VDP)

Car shoppers

Language that targets non-prime and prime car shoppers

Custom set fonts

Custom set button to match dealer website

TransUnion branding

Dealers

Wireframes and messaging strategy

We ideated on different types of language depending on their credit type, and which page the widget was on.

Based on the user feedback, car shoppers thought they had be 100% ready to buy that vehicle before clicking the widget. We wanted language that let car shoppers know they don’t have make a decision on a particular vehicle - this was simply to help them understand their credit and financing options.

Picked the language that best fit our goals for homepage, SRP and VDP - and proceeded to test them again!

Designs

Version 1 of the redesigned credit widget - different sizes to accommodate different pages and spaces on dealership websites.

To assess and validate the language and concept (understandability and desirability) of the redesigned credit widget on a dealership homepage, VDP and SRP.

Research Goals

Second phase: Validation

Likeliness to click & Expectations

Screens to test

I ran some user tests and asked users to rate their likeliness to click if they were interested in buying a car and about their expectations of what would happen after clicking the widget for understandability.

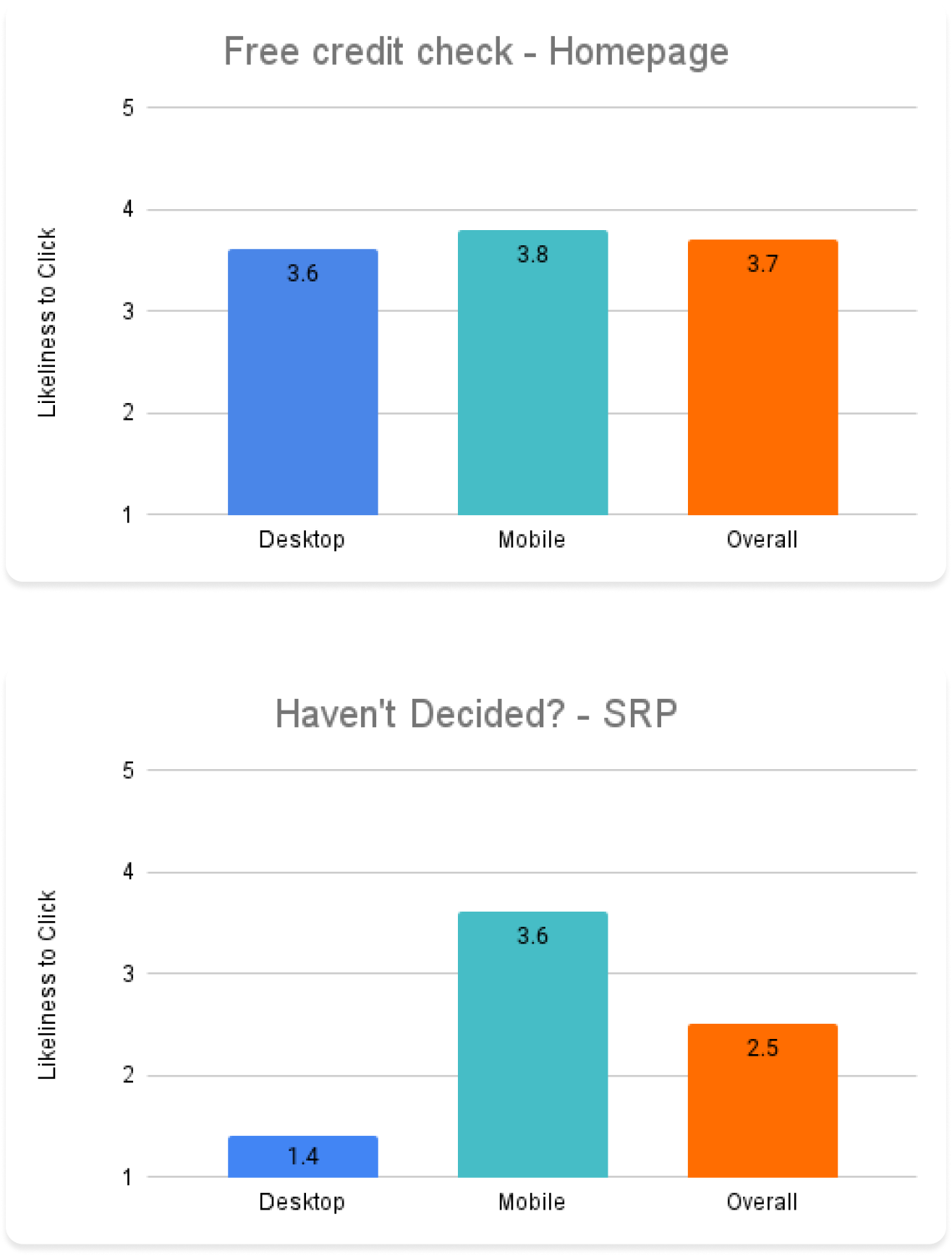

Homepage vs. SRP

Research Synthesis

Grouped key positive insights and negative insights based on test results.

The widget on the homepage (full width) had a higher likeliness to click than the SRP (small widget at the side)

There’s a negligible difference between SRP and homepage on mobile - widget is always full widget on mobile screens.

Users like the messaging that it’s free and won’t affect their credit score.

Users who rated “very likely” said the banner stands out well & looked like it was part of the page

Research Insights

Second phase: Validation

Users’ expectations of what would happen are generally correct: providing personal details for a credit check

Looking at the SRP on desktop, users say it looks like an ad

”I’m used to seeing ads on the left & right, and smaller font, haven't decided language not that attractive”

“less likely than first one - first one took up a lot of space, when it's off to the side like this one, it looks like an ad”

Final Decisions & Designs

Designs

• Advocate for full width

• Stick with one messaging across all page types for first iteration

• Avoid putting widget in sidebars

Impact & Lessons learned

Placement on websites largely determines whether users will think it’s an ad - the more space it takes up, the less likely it looks like an ad

Some dealer feedback that there is still too much white space in the full width versions - feedback to take back and iterate on

Dealers very excited about different sizes, custom fonts, button colours and round vs square corners

Developers really enjoyed the process of being part of the ideation workshops - this helped them understand the why behind product and design decisions and created alignment in the team!